Trump’s Victory Didn’t Have the Expected Outcome for the Gold Rally

In April 2020, GoldNews.com.au came under new management, articles published before this time, such as the below, may not reflect the views or opinions of the current GoldNews.com.au team.

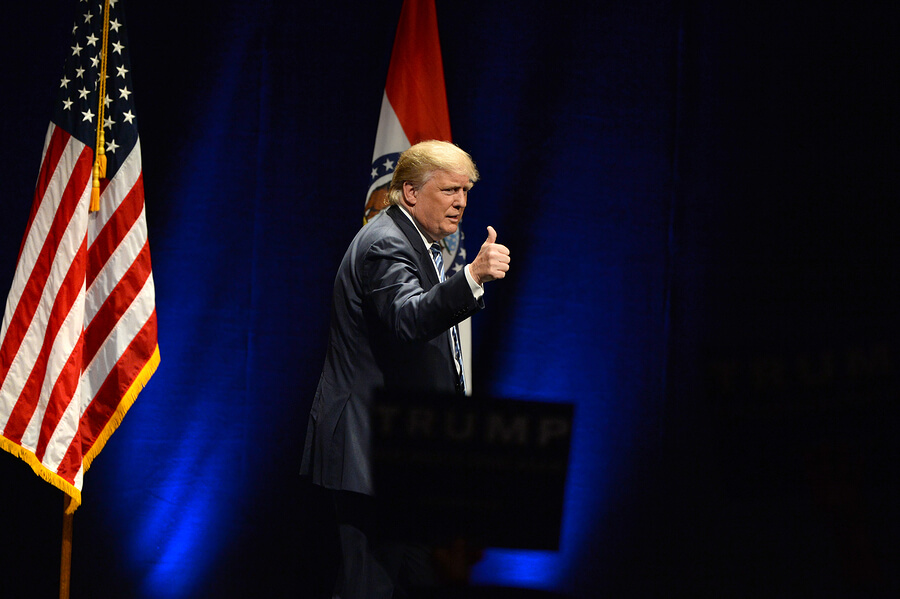

After Donald Trump’s victory at the US elections held during past November 9, the gold market reacted in a way that defied many hypotheses from outstanding experts in the financial sector.

Most people thought that the improbable winning scenario for the real estate mogul would unleash hordes of investors looking to protect their money with a safe haven like gold.

As usual in the financial world, events didn’t develop as expected. But it wasn’t only the gold market the only element that didn’t behave as most people planned in their minds and investing strategies.

ASX’s Dynamic Ride

Among the many indexes that earned big time after Trump’s victory, we must mention the S&P/ASX 200. This index includes the biggest Australian stocks listed on the ASX.

If we pay attention to data, we can see how the index went down almost two per cent from November 8 to 9. But, oddly after the US elections, the S&P/ASX 200 skyrocketed 4.15 per cent, creating substantial earns around US$214.10 in only two days.

When the post-election rally cooled down, the S&P/ASX 200 lost 0.47 per cent on Monday, after a Friday of big earnings. While this may seem like a minor loss, it wasn’t for gold mining companies that are listed in the index.

Huge individual losses were reported by Evolution Mining, Northern Star Resources, and Newcrest Mining, losing 9.7, 9.2, and 7.1 per cent respectively. Other mining companies listed suffered minor losses on the same day. These include South32 and BHP Billiton, losing 1.8 and 0.4 respectively.

There Is Still Hope

After this big plunge in gold mining stocks, the idea of having gold beyond the US$1,300-mark may seem unrealistic. But there are still experts and financial analysts that trust in the potential of the precious metal.

Mr. Joe Foster, who is the portfolio manager at VanEck Global, is sure that this is the beginning of a bright future for the gold market. He suggests that his victory means everything because all his economic policies have been hidden from the public so far. The president-elect hasn’t discussed or presented any of his economic plans in detail, so the surprise factor remains there for the upcoming months.

While this is an interesting point of view, many investors are losing faith while the gold price is going down. At the same time, Trump’s policies in the short-term could cause an increase in the US Dollar’s interest rates, something that would drag investors towards this currency in no time.

Uncertainty Is Here

Despite this situation, the gold remains as an outstanding alternative if we consider the year-to-year performance. The upcoming months will be filled with uncertainty. Once Trump arrives at the White House, abundant drastic changes are expected, mostly in trade and taxes, creating disruption in the worldwide economy.

Every single step Trump could do when he gets the power of the biggest economy in the world will have a serious reaction in the markets, frightening many investors and sending them to safe havens like gold.

Leave a Reply